By 2025, smartshops are no longer an exotic fringe phenomenon. On the contrary, they have firmly established themselves in European subculture and, in some cases, even made the leap into the mainstream. Whether it's CBD oil in a drugstore or a 1S LSD microdosing kit in an online shop – those who buy such products today are often unaware of how much the scene has changed in the last 20 years. At the beginning of the 2000s , smartshop culture looked completely different: Back then, alternative substances were mostly found in smoky headshops with Bob Marley posters on the walls, glass bong display cases, and mysterious, colorfully packaged "incense blends" whose packets usually bore the warning "not for human consumption." These shops were more of an underground meeting place than a modern store – a bit seedy, a bit adventurous.

From these beginnings, the scene developed at a rapid pace. Online shops emerged, the first "legal highs" made headlines, and changes in legislation repeatedly turned the market upside down. What was once a wild underground gradually transformed into a professional market: Modern smartshops now advertise transparency, laboratory tests to ensure product purity, and friendly customer service, while simultaneously promoting innovative new products such as HHC , 1S-LSD , and THC-P .

Smartshop culture is about more than just products. It's about the community , shared experiences at festivals and in forums – in short, a subculture that has carved out its place between the underground and the mainstream . This raises the question: How much of the underground spirit actually remains in a scene that is becoming increasingly commercial? And where is this journey headed in the future?

Key Takeaways

- Smartshops have changed dramatically since the 2000s: from smoky headshops to professional online stores with a much wider reach.

- Products in transition: From Spice & Salvia in the past to CBD, HHC & 1S-LSD today – the product range has completely changed.

- Community & Image: From a secret underground forum to a stylish social media presence and lifestyle brand – the scene has become more open and visible.

- Laws as game changers: Government regulations (e.g., the NpSG 2016) have shaped the culture and led to greater security and reliability.

- Target group growth: In addition to hardcore psychonauts, wellness fans, biohackers and spiritual explorers are now also interested in smartshop products.

- Future: New substances, progressive legalization and technological innovations keep the culture dynamic – it continues to move in the tension between commercialization and a vibrant subculture.

- 1. Early 2000s: Roots, head shops and the Goa boom

- 2. Mid-2000s: The leap to the Internet

- 3. 2010s: Wave of legislation and upheaval

- 4. Today: Professionalization, Lifestyle & Mainstream

- 5. New consumption patterns and growing target groups

- 6. Subculture vs. Mainstream: Areas of Tension

- 7. International Differences

- 8. Psychedelic Renaissance: Science and Image Change

- 9. The Future of Smartshop Culture

- 10. FAQ

- 11. Disclaimer

Early 2000s: Roots, head shops and the Goa boom

In the early 2000s, the world of smartshops was completely different than it is today. Back then, there were no widespread online shops, and anyone looking for "alternative substances" had to visit a physical headshop in person. The roots of this scene actually lie in the Netherlands in the 1990s: the first smartshop, Conscious Dreams , opened in Amsterdam in 1993, and by 2001, around 150 smartshops had sprung up across the country. In the rest of Europe, the number of such shops also increased in the early 2000s – especially in major cities. These early headshops exuded a unique charm: they were often small, somewhat dimly lit, and full of quirky accessories – from bong display cases to blacklight posters. Customers met there not only to shop but also to chat and exchange experiences, so the shop often served as a meeting place for the scene .

Products: Among the favorites of that era were so-called incense blends , sold as supposedly harmless bundles of herbs. In reality, these often contained herbs soaked in synthetic cannabinoids, which, when smoked, produced cannabis-like—sometimes even considerably stronger—effects. A well-known name from this era is Spice , an herbal mixture that suddenly gained enormous popularity in the mid-2000s and skyrocketed as a legal cannabis alternative. Also highly sought after was Salvia divinorum , a then-legal but very potent natural hallucinogen (divination sage). Furthermore, one could find exotic ethnobotanicals on the shelves, such as Hawaiian baby woodrose (LSA-containing seeds), kratom powder, or energizing capsules with guarana and ephedra. All these products were relatively easy to obtain, but their actual effects were an experiment with an unknown outcome for many customers. Almost all items bore the imprint "not for human consumption" for legal reasons, which of course did not deter anyone from trying them.

Culture: The scene of the early 2000s was closely intertwined with Goa and psytrance culture . Colorful open-air festivals and smoky basement clubs provided fertile ground for experimenting with mind-altering substances. Head shops functioned not only as sales outlets but also as social hubs : people shared experiences, gave each other tips, and browsed obscure product catalogs together. The community was small, close-knit, and characterized by its underground nature —many knew each other from internet forums or the same festival spots. Professional marketing was virtually nonexistent. News about the latest "miracle drug" usually spread by word of mouth or, at most, via flyers distributed in clubs. The shop owners preferred to remain under the radar; they wanted to avoid too much attention from the media or authorities.

A typical purchase in those days: a packet of Spice or a bag of Salvia , often without any list of ingredients or dosage instructions. The fact that some of these legal highs could be extremely potent or pose a health risk was rarely discussed publicly. People operated in a legal gray area and simply hoped for the best. The downside of this unregulated freedom became apparent in some negative headlines – but more on that later.

Mid-2000s: The leap to the Internet

With the rise of the internet in the mid-2000s, a new chapter in smartshop culture began. Suddenly, legal highs and other drugs could be conveniently ordered from home – anonymously and discreetly. The first online smartshops went live, often as simple websites that didn't exactly boast a stylish design, but made a clear promise: "Discreet shipping – 100% legal alternatives!" For many consumers, this was revolutionary: no more dimly lit shops and no more curious glances – instead, they could browse the virtual selection and have their goods delivered by mail. The internet thus made smartshop products accessible to a much wider audience, even outside of major cities. Those who previously didn't dare to enter a headshop or didn't have one nearby now only needed a few mouse clicks.

Shops & Products: Alongside the well-known herbal mixtures, the first research chemicals (RCs) appeared during this period. These were novel, chemical relatives of known drugs that were (still) legal. For example, 2C-B analogs (variants of the psychedelic 2C-B) became popular, and the first experimental LSD derivatives circulated in the scene. Novel stimulant party pills and so-called bath salts (synthetic cathinones) also conquered the market. The product range practically exploded: anything that was still legal was offered by enterprising shops. Consumers could, for example, buy BZP-containing stimulant pills as a supposedly harmless alternative to ecstasy, until these too were eventually banned. In this golden age of the "chemical toolkit," it felt as if something new was released every month , just waiting to be tested.

Community: As online shops grew, so did online communities. International forums like Erowid and Bluelight , as well as German platforms like Land der Träume and Eve&Rave, became the scene's knowledge base. Detailed trip reports , discussions about dosages, and initial warnings about risks emerged here – the collective knowledge of psychonauts was shared. For the first time, consumers could connect directly across national borders: A trip report from Berlin was read and commented on by someone in Amsterdam or London, and vice versa. This digital network increased transparency : People were no longer alone with their experiments but learned from the mistakes and successes of others. The scene began to think and act more globally.

This new online world fundamentally changed the dynamics of smartshop culture. Knowledge spread faster, and trends swept from one country to the next in no time. Those who previously experimented in isolation within their own circle of friends could now learn from the experiences of hundreds of others – a true game-changer for security and a sense of community . Today's online smartshops are also significantly more user-friendly and trustworthy than their predecessors. Where simple HTML pages sufficed back then, you can now expect a sophisticated shopping experience – including in our shop 😉. But before reaching this point, the scene still had to overcome a few hurdles…

Table: Development of smartshop culture since 2000

| Period | Typical products | Scene/Community | Special features |

| Early 2000s | Incense blends, Salvia divinorum, ethnobotany (herbs, seeds) | Goa & Psytrance scene, head shops as meeting places | Little information, lots of word of mouth; legal gray area |

| mid-2000s | Spice, first RC pills (2C-B analogues), BZP pills | Online forums, global exchange, first online shops | Launch of online retail; legal highs experience a short-term boom. |

| 2010–2015 | “Bath salts” (e.g., mephedrone), 2C-X & NBOMe, truffles (legal mushroom alternatives) | Forums and festivals, growing media attention | First major waves of bans (Analogs Act, EU-wide bans); negative headlines in the media. |

| From 2016 | CBD oils and flowers, kratom, legal RCs (e.g. 1P-LSD) | Social media, YouTube, lifestyle magazines | NpSG in Germany (2016) → Professionalization; focus on quality and reliability |

| Today (2025) | HHC, THC-P, 1S-LSD, microdosing kits, CBD & nootropics | Broad target audience (from experts to newcomers), mainstream interest | Laboratory tests, transparency, mainstreaming of the scene |

2010s: Wave of legislation and upheaval

The 2010s brought turbulent times to the smartshop scene – a veritable wave of regulation swept across what had previously been a largely unregulated landscape. In Germany, Austria, and many other EU countries, governments began banning numerous substances from 2010 onwards with so-called analogous laws and specific New Psychoactive Substances Acts (NpSG). The German NpSG of 2016, in particular, marked a turning point: it came into force and suddenly made entire product categories illegal. The UK took a similarly drastic approach with the Psychoactive Substances Act 2016, which banned almost all psychoactive substances (excluding established drugs like alcohol, nicotine, etc.) across the board. These laws were a reaction to the overwhelming flood of new drugs and several dramatic incidents – they put an end to the previously rampant supply of legal highs.

The consequence for shops: Many once-popular products disappeared from the shelves virtually overnight . Retailers received lists of substances that could no longer be sold from one day to the next. As a result, some smartshops had to close, while others relocated abroad to continue operating. For the scene, this was a shock – but also a wake-up call to adapt.

New Trends: Necessity gave rise to new opportunities. Instead of risky research chemical cocktails, substances that had remained legal moved into focus. Arguably the biggest winner of this development was CBD : products from the hemp plant without psychoactive effects (oils, flowers, edibles) conquered the market and attracted a completely new audience. Kratom (a plant powder with mild opioid-like effects from Southeast Asia), as well as various smokable herbs and adaptogens, also filled the gap. This green market developed explosively . Alongside this, legal research chemicals continued to appear – now often as niche products and with a decidedly scientific presentation. The scene was searching for safe havens and found them in natural products and gentler alternatives.

Cultural shift: The legal changes were accompanied by a noticeable shift in image . The focus moved away from sensationally advertised "legal highs" towards reliability and safety. Smartshops responded with greater transparency and professionalism: lab tests and purity certificates became standard, webshops more user-friendly and informative, and the language used with customers more objective. The image changed – from a disreputable headshop to a trustworthy online retailer. Many shops now emphasized aspects such as quality, advice, and responsible practices. Terms like " incense blend " or " bath salts " disappeared in favor of more neutral descriptions. In short, the smart shop culture matured . From an experimental underground scene, a market emerged that strives for credibility —not least to ensure its long-term survival.

Today: Professionalization, Lifestyle & Mainstream

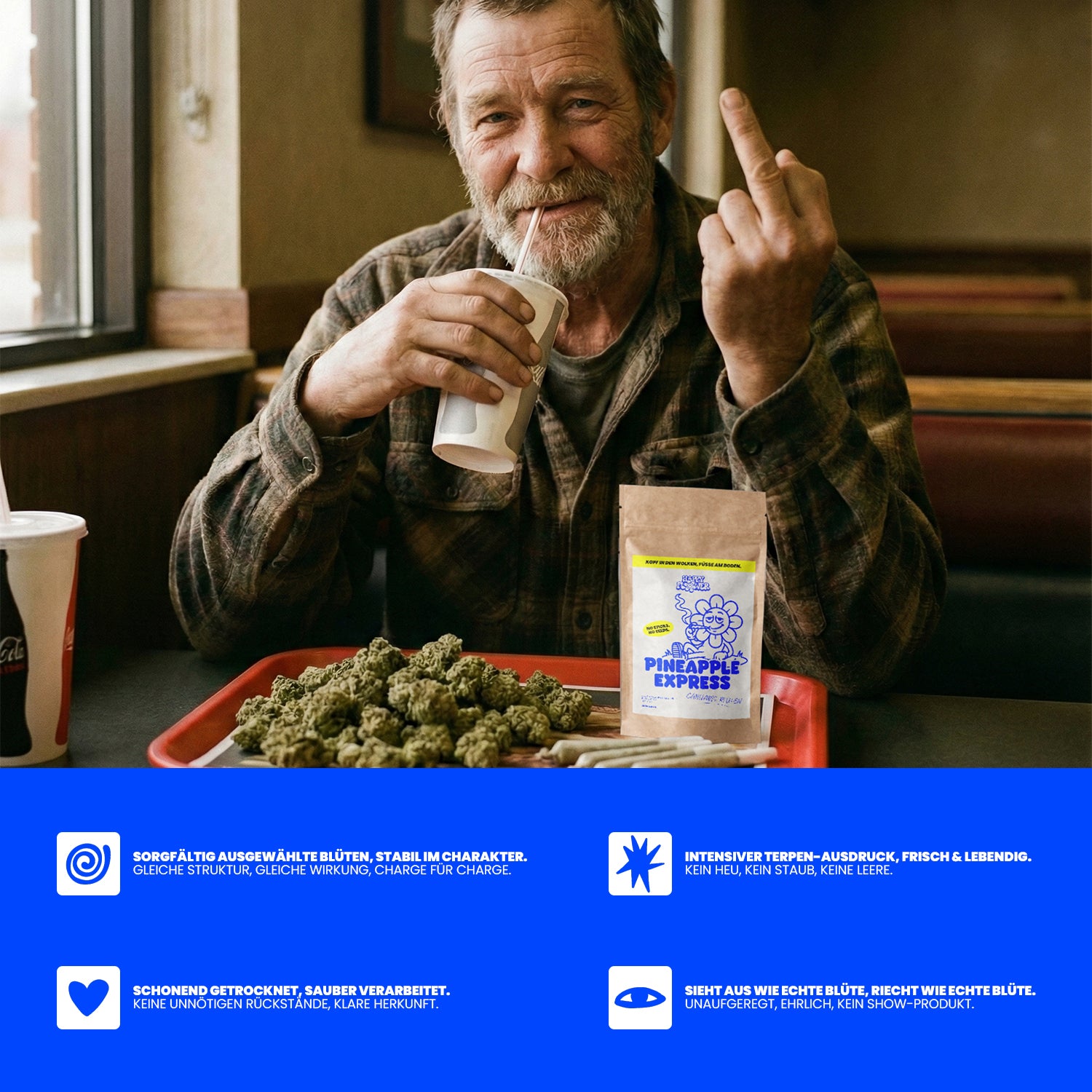

Modern smart shops in 2025 are almost unrecognizable. They focus on branding , social media marketing, and a customer experience more reminiscent of a lifestyle brand than an underground store. Many retailers now consciously present themselves in a stylish way: with Instagram feeds full of product photos, influencer collaborations, and blogs (like this one) on the topic. A visit to an online smart shop should be fun and inspire trust – a far cry from the shadowy secrecy of the past.

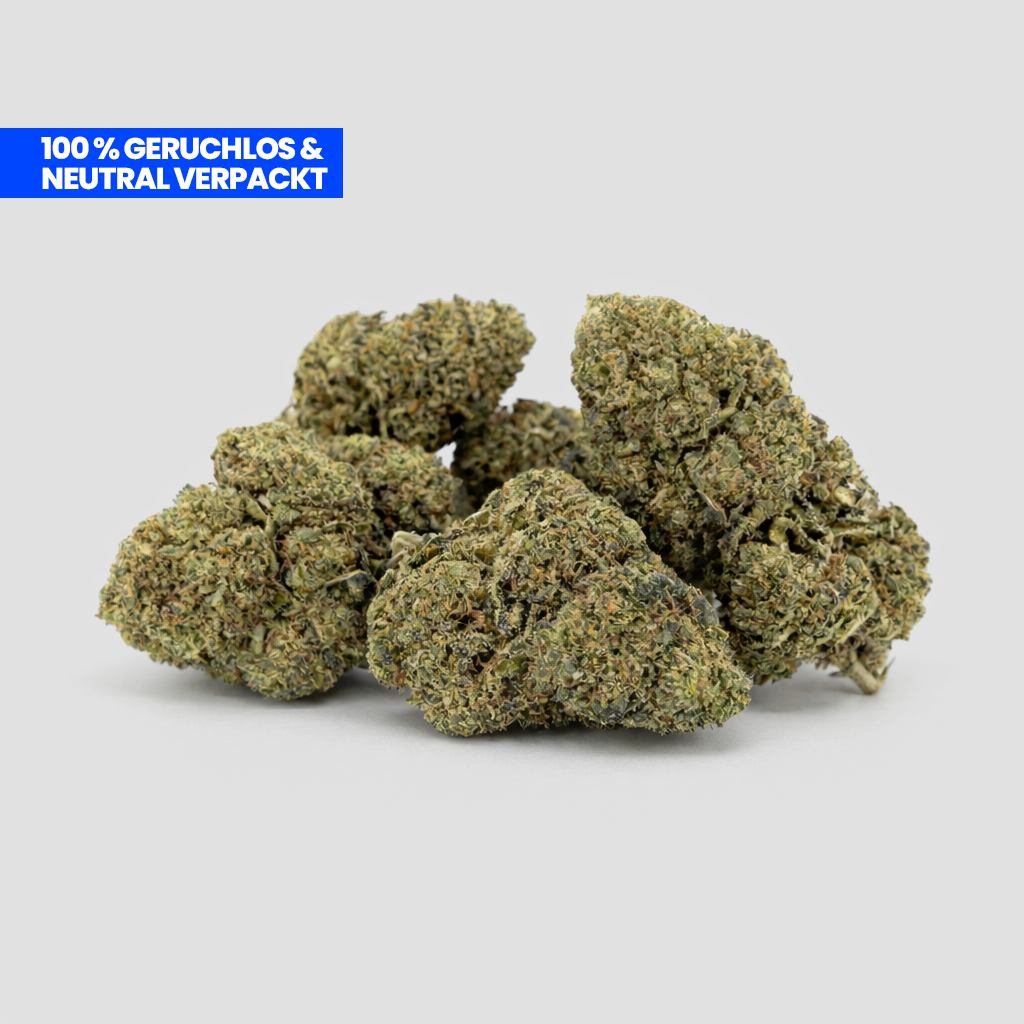

Products today: The product range has adapted to new rules and trends. Classics like CBD flowers , oils, and hemp gummies are now part of the standard repertoire of almost every shop. New trend substances have also emerged: for example, HHC (a semi-synthetic cannabinoid with a mild, cannabis-like effect), THC-P (an extremely potent cannabinoid derivative), and 1S-LSD (a legal variant of the LSD molecule, popular for microdosing). Legal microdosing products based on mushrooms (e.g., truffle microdoses) and nootropic lifestyle substances (such as focus capsules with Lion's Mane or Ashwagandha ) also appeal to a broad audience today. The variety is enormous – and there's something suitable for every user, from the relaxed CBD tea drinker to the adventurous psychonaut .

Target audience: The customer base has broadened more than ever before. It's no longer just festival-goers, Goa enthusiasts, and cannabis users who are drawn to these products, but also curious individuals without a scene background , wellness and self-care enthusiasts , and career-oriented people looking for a certain thrill (keyword: microdosing ). Even older generations and health-conscious individuals are suddenly interested in smartshop products – thanks to CBD and similar products. What was once a small group of insiders is now socially acceptable . As early as 2009, an online shop owner in the UK reported that his customers ranged from students to university professors – even a professor, a photographer, and a yacht salesman were among his regular customers. He observed: "Our customers aren't just 18-year-old stoners; there's a whole culture of sensible people out there." This quote from over 15 years ago vividly illustrates how much the image of the typical consumer has changed.

Transparency & Security: Modern online shops score points with trust . Lab reports , certificates of analysis, and clear safety instructions are now readily available. Emphasis is placed on providing information: Dosage instructions, information on drug interactions, and FAQs (see below) are often found on the websites. Many suppliers cooperate with testing laboratories or publish batch analyses to guarantee quality. This kind of transparency was desirable in the 2000s – today it's standard practice. The result: Customers can be significantly more confident about what they consume than they could have been 20 years ago.

Through all these developments, the smartshop scene has entered the mainstream . CBD products can now even be found in drugstores and shopping malls; microdosing is discussed in lifestyle magazines and podcasts; and terms like psychedelics or ayahuasca are no longer taboo in mainstream society. At the same time, an underground scene continues to exist where harder research chemicals circulate and experimentation takes place. The culture has essentially split in two: commercial and professional on the one hand, and subcultural and experimental on the other. Both spheres coexist and influence each other—a large, public scene with legal offerings and a small, hidden one with clandestine experiments. But both share the same root: the fascination with consciousness-expanding experiences.

New consumption patterns and growing target groups

In the past, many consumers were primarily interested in one thing: getting high and partying . Smartshop products of the 2000s were mostly consumed at festivals, in clubs, or among friends, for fun or to try something new. Today, however, a significantly changed consumption pattern is emerging. More and more people are using these substances consciously and purposefully – be it for self-improvement, relaxation, or spiritual purposes.

A prominent example is the trend of microdosing . This refers to the regular intake of minimal doses of psychedelics (e.g., LSD or psilocybin) without fully experiencing a high. This phenomenon has created a whole new user group: the self-optimizers . They expect tiny amounts of LSD in the morning to boost creativity and concentration for the workday. What was once ridiculed as hippie eccentricity is now considered a secret weapon by startup founders and creative directors. In tech circles around Silicon Valley, microdosing is almost mainstream – and in Germany, too, more and more professionals are becoming interested in this form of brain hacking .

Nature lovers and wellness enthusiasts are also discovering the world of smart shops. Many of them prefer plant-based substances and extracts to synthetic drugs. They experiment with traditional entheogens like peyote cacti, magic mushrooms (or legally available truffles), or ayahuasca preparations during retreats to gain personal insights—far removed from parties and noise. Others turn to adaptogens and gentle aids for everyday life, such as herbal blends for better sleep or microdoses of medicinal mushrooms (non-psychoactive varieties like Lion's Mane for cognitive function). For them, health and self-discovery are paramount, not the thrill.

Another growing group consists of spiritual users . They use psychedelic experiences specifically for personal development, meditation, or therapy. Instead of purely recreational use, their focus is on self-discovery —for example, processing old traumas, unleashing their own creativity, or experiencing a deep connection with nature. Renewed scientific research on psychedelics and reports on their therapeutic potential have given this group a boost. What once took place in the shadows of shamanic ceremonies is now entering the public eye thanks to Netflix documentaries and best-selling books. Suddenly, even more conservative people are discussing the psychological benefits of psilocybin-supported coaching.

Overall, the typical smartshop customer today can hardly be pigeonholed. He or she might be 20 or 60 years old, work in a bank or as a yoga teacher – and pursue completely different goals. This opening up of consumer culture shows how much the scene has changed: from a close-knit circle of insiders to a broad community in which curiosity , personal responsibility, and personal growth play central roles.

Subculture vs. Mainstream: Areas of Tension

Smartshop culture has always thrived on the tension between underground and mainstream . Now that it's gaining more recognition, this tension is more apparent than ever. The scene used to be small, rebellious, and non-commercial – strongly associated with specific music (Goa, Psytrance, Techno) and a certain countercultural attitude. Today, smartshops are professional shops with a stylish presentation, influencer marketing, and a strong social media presence. What was once whispered about in secret now jumps out at you as an advertisement on Instagram.

This raises the question: Is the scene losing its "soul" in the process? Or was this step towards professionalization perhaps necessary to provide consumers with greater security? Opinions within the community are divided. Some long-time veterans mourn the "golden age" when everything was smaller, more secretive, and, in their eyes, more authentic . They fear that the commercialization of the culture is robbing it of its original spirit—the spirit of experimentation, the sense of community, the rebelliousness. Newcomers, on the other hand, welcome today's openness. Finally, there's no longer any need to feel ashamed or afraid to try a legal high. The transparency and quality of 2025 give many a sense of security that was previously lacking—and allow more people to become curious in the first place.

The truth, as is so often the case, probably lies somewhere in the middle. Smartshop culture now faces the challenge of keeping its roots and creative subculture alive while simultaneously gaining mainstream acceptance. It's a balancing act: preserving the spirit and innovation of the underground renaissance while also leveraging the advantages of professionalization – better products, greater security, and wider acceptance. This tension between authenticity and commercialism will likely continue to define the scene in the future.

International differences

Smartshop culture varies greatly from country to country – each country has its own laws and therefore its own distinct scene. Let's look at some examples in Europe:

- The Netherlands: This is where it all began. The Netherlands is the undisputed pioneer market for smart shops. The first smart shop opened its doors in Amsterdam back in the 1990s, and such shops remain legally established there to this day. You can openly buy truffles , salvia , CBD , and microdosing products. After the ban on dried magic mushrooms in 2008, the shops simply switched to the still-legal magic truffles (psilocybin-containing sclerotia) – a testament to their creative adaptability. The open drug policy ensures that you can talk about microdosing quite freely in Amsterdam shops, while in other countries much of it remains behind closed doors. Overall, the tolerant attitude in the Netherlands has fostered a vibrant smart shop culture, also attracting tourists, where education and quality are paramount.

- Germany: The situation here is considerably more restrictive . Online smartshops operate in a legal gray area, and physical stores with a wide selection of products are virtually nonexistent. Those who want to sell smartshop items in Germany usually do so online, often with the disclaimer "for research purposes only" (to circumvent drug laws). Local headshops typically limit themselves to accessories like bongs, grinders, and seeds – they rarely carry psychoactive products, as many substances are subject to narcotics legislation. As a result, much of the activity in Germany is discreet, and the scene is comparatively small. While microdosing is openly discussed in shops in Amsterdam, much of it still happens behind closed doors in Berlin. On a positive note, CBD and hemp products are becoming more widely known here as well – but overall, the smartshop culture in Germany remains cautious and secretive.

- Spain: In Spain, cannabis social clubs dominate the alternative drug scene. These member-based clubs (primarily in Catalonia) permit cannabis consumption in private settings and enjoy a tolerated status. Smartshops in the traditional sense are more of a niche market. While there are headshops and some stores selling, for example, herbal extracts, seeds, or psychedelic truffle kits , the general public is more aware of cannabis culture. A unique feature in Spain is the vibrant festival scene (e.g., psytrance festivals), where smartshop products are certainly available – but the surrounding infrastructure is not as developed as in the Netherlands.

- Austria & Switzerland: Both countries have similarly strict legislation to Germany, but each has its own distinct focus. In Austria , the New Psychoactive Substances Act was introduced as early as 2012, effectively ending the legal high scene early on. Head shops there—where available—concentrate on CBD and classic smoking accessories. In Switzerland , small amounts of cannabis have been decriminalized for several years, and CBD hemp (up to 1% THC) is legal, leading to a small boom in CBD shops. However, other substances (psychedelics, research chemicals) are prohibited, just as in neighboring countries. Overall, this means that what is openly available in one country may be strictly forbidden in another. Cross-border online shopping is therefore common for many enthusiasts. For example, some Germans order their truffles from the Netherlands—always keeping an eye on the legal situation.

Psychedelic Renaissance: Science and Image Change

In recent years, we have witnessed a true renaissance of psychedelics – and this has not gone unnoticed by the public. Renowned universities and research centers worldwide – from Johns Hopkins University in the USA to Imperial College London – have launched new programs to study psychedelic substances. Substances such as LSD, psilocybin (from magic mushrooms ), and MDMA, once notorious as dangerous drugs, are now being investigated in clinical trials for their therapeutic potential. Initial results are promising: In one study, for example, around 71% of patients who received psilocybin for severe depression reported at least a 50% reduction in symptoms – in half of the cases, the depressive symptoms disappeared completely. Such headlines are suddenly transforming formerly disreputable “hippie drugs” into potential cures .

At the same time, some regions are relaxing their laws. In several US states, psychedelic therapies have recently been legalized, or at least the substances have been decriminalized. In Europe, there is also cautious discussion about medical applications (such as psilocybin in psychotherapy). The media are already talking about a “ psychedelic revival .” Popular Netflix documentaries and bestselling books (e.g., by journalist Michael Pollan) have brought the topic into mainstream living rooms.

All of this contributes to a shift in perception . Psychedelic substances are increasingly viewed as serious tools for therapy and personal growth , instead of being dismissed outright as the devil's work. The old stigma is crumbling. For smartshop culture, this development is a boon: Increased public interest and scientific legitimacy make it easier to talk openly about substances and reach new customer groups. When respected researchers attest to the potential positive effects of LSD and other psychedelics, people who would never have considered it before suddenly feel comfortable entering a smartshop. Of course, skepticism persists among some segments of the population – but overall, fear is increasingly giving way to a curious openness . And this openness creates space for further progress and innovation within the scene.

The future of smartshop culture

The future of smartshop culture promises to remain exciting. Much depends on the ongoing legalization debate : Should cannabis become legal in more and more countries (Germany, for example, is planning initial steps in 2024), smartshops could receive a new boost – or face competition from state-licensed retailers. On the one hand, a wave of legalization would further normalize such offerings (those who can freely purchase THC products are less hesitant to try other smartshop goods). On the other hand, large corporations or pharmaceutical companies could enter the market, which would mean increased competitive pressure for existing providers.

New substances: One thing is certain: the chemical industry remains inventive. New cannabinoid variants and designer psychedelics are constantly being developed to stay one step ahead of the legal gray areas. Manufacturers are already experimenting with compounds like HHC-O or THC-O (acetates that are said to be even more potent) and novel lysergamides – variants of the LSD backbone that are (still) legal. Such innovations will continue and are likely to set tomorrow's trends. The industry has shown in the past that it adapts quickly: no sooner is one substance banned than the next one is waiting in the wings. This cat-and-mouse game between chemists and legislators is therefore likely to continue.

Technology & Sales: There are also likely to be significant technological developments. E-commerce and digitalization will further enhance the smart shop experience. For example, personalized recommendations via AI are conceivable – shops that suggest the optimal microdosing product based on your profile. Or special apps that support safe consumption (such as timers for dosing intervals, communities for sharing experiences). Perhaps we will also see VR experiences at trade fairs and festivals where the effects can be virtually simulated before purchase. And in terms of shipping , delivery drones or ultra-fast delivery services could make online shopping even more attractive in the future. In short: Technological advancements will likely make the smart shop scene even more convenient and interconnected.

Commercial vs. Niche: It's also conceivable that the aforementioned division within the scene will intensify. A large segment will become highly professional and geared towards mass production – perhaps one day we'll see official shelves for certain smartshop products in regular stores. At the same time, however, there will always be niche communities that experiment outside the mainstream and form new subcultures. These small circles might focus on particularly unusual new substances or cultivate ancient rituals (e.g., traditional herbal medicine), independent of commercial activity. Both currents – the large market and the small underground communities – will continue to coexist and inspire each other.

Either way, the smartshop culture is constantly evolving. For enthusiasts and the curious, that means there's never been a better time to see for yourself. Discover the vibrant world of our smartshop now and find out what fascinates you most. Your next chapter in this story is waiting to be written!

FAQ

When did the smartshop scene begin in Europe?

Its roots lie in the Netherlands in the late 1990s. However, the scene really took off in the early 2000s – with head shops in major cities offering legal alternatives to the then-illegal drugs. From there, it quickly spread to other countries.

Which products dominated back then?

In the 2000s, herbal incense blends (such as Spice) and Salvia divinorum were particularly popular. Alongside these, there was a wide array of plant extracts, seeds, and early synthetic research chemicals that were still legal. These products characterized the early days of smart shops, before CBD and other similar products later emerged.

How have laws changed the scene?

Laws have had a huge impact. Various bans since the 2010s (e.g., the 2016 New Psychoactive Substances Act in Germany) caused many original legal highs to disappear from the market. This forced the scene to reinvent itself: Today, instead of Spice and similar substances, CBD, HHC, and other remaining legal substances are more prominent. Overall, regulations have restricted the range of products available, but they have also made them safer and more professional .

Are smart shops safer today than they used to be?

Yes – at least with reputable vendors, smartshop products are significantly safer today than they used to be. There are lab tests, purity certificates, and clear information on effects and dosage, which was rarely the case before. Of course, a residual risk remains, but compared to the unlabeled packages of the 2000s, things have improved considerably.

Disclaimer

This article is for informational purposes only and is not intended to encourage anyone to consume 3-FPO or similar products. Our products are intended solely for scientific purposes. Please always inform yourself about the current legal regulations in your country before purchasing.

https://happyflower.io

https://happyflower.io

Share:

THC Space Shots Explained: Effects, Risks & Hype 2025

Research Chemicals Explained – Opportunities, Risks and the Role of Smartshops